Stock option trading is a dynamic and complex market where investors can use a variety of strategies to hedge, speculate, or enhance returns. These strategies can be tailored to different risk appetites, and understanding how to employ them effectively requires knowledge of the key concepts involved. One such set of concepts is the Greek letters, which represent various factors that affect the price of options. In this article, we will delve into the significance of the Greek letters, and explore some common options strategies such as the Iron Condor.

1. What are Stock Options?

Before diving into the details of trading strategies, it’s important to understand what stock options are. A stock option is a financial contract that gives an investor the right (but not the obligation) to buy or sell a stock at a predetermined price, known as the strike price, within a certain period. There are two types of options: call options and put options. A call option allows the investor to buy the stock, while a put option allows them to sell the stock.

Stock options provide investors with a way to profit from changes in stock prices without actually owning the stock. However, the complexity lies in the multiple factors that influence an option’s price, and this is where the Greek letters come into play.

2. The Greek Letters and Their Significance

The Greek letters (also known as “Greeks”) are a set of variables used to measure the sensitivity of an option’s price to different factors. They help traders understand the risks and rewards associated with an option position. Let’s explore each Greek in detail:

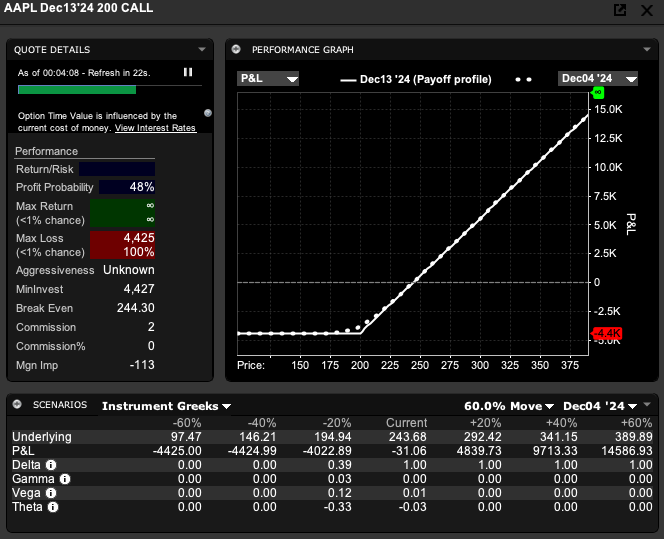

- Delta (Δ): Delta measures the rate of change in the option’s price relative to a $1 change in the underlying stock price. A delta of 0.5 means that for every $1 move in the stock, the option’s price will move by $0.50. Call options have positive deltas (ranging from 0 to 1), while put options have negative deltas (ranging from 0 to -1). Traders use delta to estimate the probability of an option expiring in-the-money.

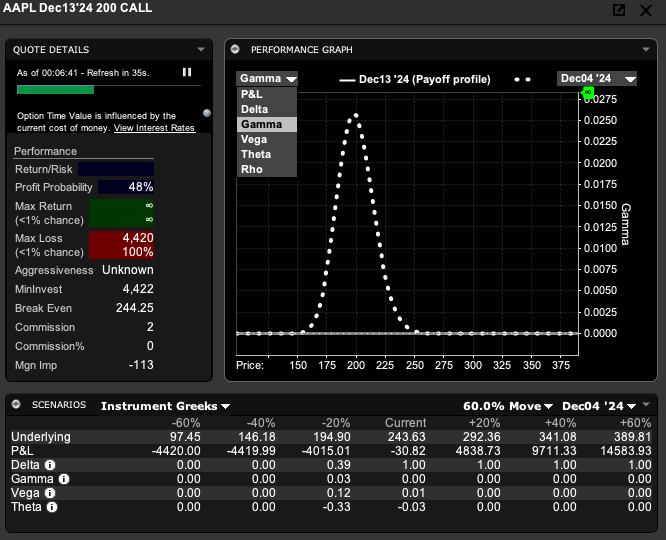

- Gamma (Γ): Gamma represents the rate of change in delta as the underlying stock price moves. Essentially, it measures the convexity of the option’s price curve. High gamma means that delta is more sensitive to changes in the underlying stock price, and it becomes important for managing the risks of options with large movements in the underlying asset.

- Theta (Θ): Theta measures the time decay of an option’s price. As options approach expiration, their value tends to decrease due to the diminishing time left to exercise them. A negative theta indicates that the option is losing value as time passes. Theta is particularly crucial for options traders who are holding positions over longer periods.

- Vega (ν): Vega measures the sensitivity of an option’s price to changes in the volatility of the underlying asset. If volatility increases, options tend to become more expensive, and a higher vega means the option’s price will move more significantly with changes in volatility.

- Rho (ρ): Rho measures an option’s sensitivity to interest rate changes. For instance, if interest rates rise, the price of call options tends to increase, and the price of put options tends to decrease. Rho is typically more relevant for long-term options or options with higher strike prices.

Common Stock Option Trading Strategies

Now that we have a basic understanding of the Greek letters, let’s explore some of the most popular options strategies used by traders. Each strategy uses different combinations of calls and puts to achieve specific goals, such as generating income, hedging, or speculating.

a. Iron Condor

The Iron Condor is a popular neutral strategy that involves four option contracts: a short call and a long call at higher strike prices, and a short put and a long put at lower strike prices. These options are all out-of-the-money at the start. The goal of the Iron Condor is to profit from low volatility in the underlying asset.

- How It Works: The trader sells a lower strike put, sells a higher strike call, buys a lower strike put for protection, and buys a higher strike call for protection. The position profits if the stock price stays within the range of the short strike prices, and the maximum loss occurs if the stock price moves significantly outside of this range.

- Why It’s Used: This strategy is most effective in a market that shows little movement or in a situation where a trader believes that the stock price will not move much within the expiration time frame. The trader’s profit is limited to the net premium received from the options, while the risk is also limited to the difference between the strike prices minus the premium received.

b. Covered Call

The Covered Call is a conservative strategy where the investor owns the underlying stock and sells a call option on that stock. This strategy allows the investor to generate additional income through the premium collected from the call option, while still holding the stock.

- How It Works: The investor sells a call option on a stock they already own. If the stock price stays below the strike price, the option expires worthless, and the investor keeps the premium as profit. If the stock price rises above the strike price, the investor is obligated to sell the stock at that price, but they still keep the premium as a bonus.

- Why It’s Used: This strategy is ideal for investors who have a neutral to slightly bullish view on the stock. The covered call limits the upside potential of the stock but provides downside protection through the option premium.

c. Protective Put

A Protective Put is a hedging strategy that involves buying a put option for a stock you own. This strategy provides insurance against significant declines in the stock price.

- How It Works: The investor buys a put option while holding the stock. If the stock price falls, the value of the put option increases, offsetting the loss in the stock price. The downside is that the investor pays a premium for the put option, which reduces the overall return.

- Why It’s Used: This strategy is useful for investors who are concerned about downside risk but want to maintain their stock position. It provides a safety net if the stock price drops significantly.

d. Straddle

A Straddle is a strategy where an investor buys both a call and a put option with the same strike price and expiration date. This strategy profits from large price movements in either direction.

- How It Works: The investor buys both a call and a put option on the same underlying asset. The position profits if the stock moves significantly in either direction, covering the cost of the options and generating a profit. However, if the stock price remains stable, the strategy can result in a loss due to the cost of the options premiums.

- Why It’s Used: This strategy is used when an investor expects high volatility but is uncertain about the direction of the price movement.

4. Conclusion

Stock option trading offers a wide range of strategies that can suit different market conditions and risk profiles. Understanding the Greek letters—delta, gamma, theta, vega, and rho—is crucial for evaluating the sensitivity of options to various factors such as stock price movement, time decay, and volatility. By mastering these concepts, traders can better navigate the complexities of the options market and select strategies like Iron Condors, Covered Calls, and Protective Puts to achieve their financial goals. With proper knowledge and strategy implementation, stock options can be a powerful tool in an investor’s trading arsenal.

Leave a Reply